Blog

International Women’s Day

Mar 22, 2024

On Friday 8th March, we celebrated International Women's Day in all our offices with a guest speaker and a morning tea. Director of Tri-Altitude Performance and Podcast Host, Ali Flynn, led a discussion with our team, touching on the importance of accountability in...

Is your not-for-profit organisation prepared for the upcoming changes in reporting requirements?

Mar 22, 2024

As part of the Federal Budget on 11 May 2021, the Australian Government unveiled adjustments to the administration requirements of not-for-profit entities that self-assess for income tax exemption. Starting July 1, 2023, non-charitable not-for-profit’s holding an...

Dux of CTA2A Advanced Steven Tanner

Mar 22, 2024

Steven Tanner, our Manager in the Brisbane office, was recently awarded Dux of CTA2A Advanced for Study Period 3 2023. A fantastic result in an advanced tax course, congratulations Steven! We asked him a few questions to reflect on his achievement and provide some...

Changes to Superannuation Caps

Mar 22, 2024

For the first time in three years, superannuation contribution caps will be increasing, with the changes coming into effect from 1 July 2024. Contribution cap increases are linked to average weekly time ordinary earnings (AWOTE) figures, with a figure greater than...

Introducing our newest Partner…

Mar 22, 2024

Robert Waters advanced to Partner on the 1 March 2024, recognising his experience and professionalism and being a valued member of the Armidale and Glen Innes Business Services teams. We asked Robert a few questions about his new role and his time with us at Roberts +...

Harmony Day

Mar 22, 2024

On Thursday the 21 of March, our team celebrated Harmony Day in all of our offices with a lunch. Our team members shared a selection of their favourite dishes from their cultural background or something delicious from their family. This day is about recognising the...

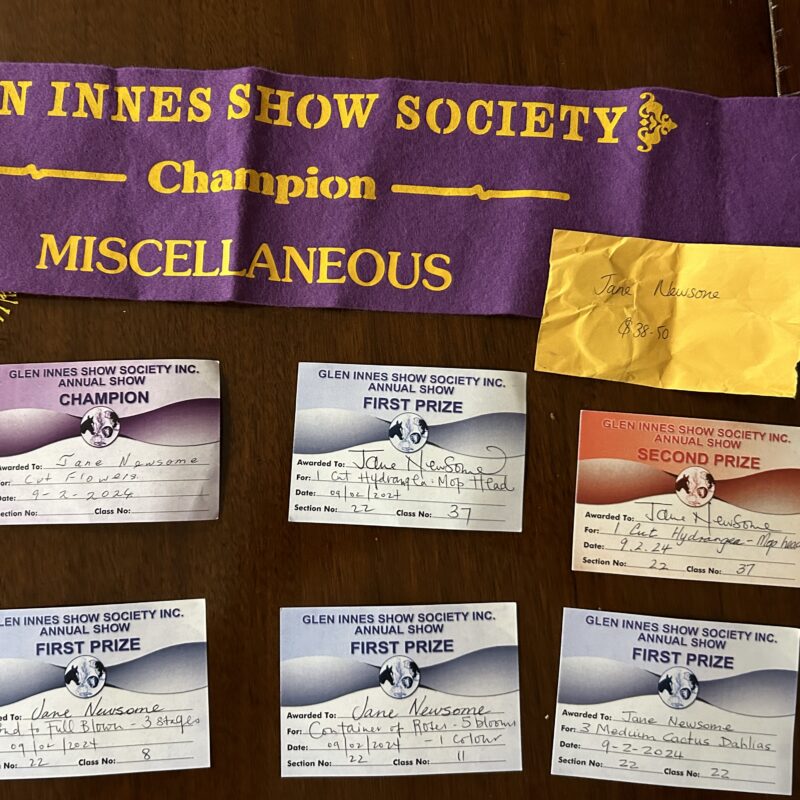

Glen Innes Show

Feb 29, 2024

Our fabulous Partner, Jane Newsome who is based in our Glen Innes office won 1st and 2nd place across six of her stunning flowers at the Glen Innes Show. Roberts + Morrow supports this great community event in Glen Innes and would like to thank all those involved in...

Count National Conference

Feb 29, 2024

Our Senior Financial Planner, Wayne Higgins (pictured on the left), and Business Services Partner, Joel Weier (pictured on the right) are pictured below at the National Arboretum overlooking beautiful Canberra city as they attend the Count National Conference. A great...

Xero – Do Beautiful Business

Feb 29, 2024

Did you know Roberts + Morrow is a Xero accredited practice? Whilst there are many software options available out there to assist you with your bookkeeping requirements, Xero allows you to reconcile your income and expenses, process pay runs and stay on top of your...

Congratulations on 25 years!

Feb 29, 2024

Our Brisbane Partner, Jason Simmonds, recently reached a special milestone. Celebrating 25 years as a Partner of Roberts + Morrow, well done Jason on a wonderful achievement. We thank you for your hard work and dedication to the firm. In 2021, Jason led an exciting...

Accounting and Business Advice for Farmers

Feb 14, 2024

Tax Incentives for Electric Vehicles

Feb 1, 2024

From 1 July 2022, employers do not pay FBT on eligible electric cars and associated car expenses if they meet the following conditions: The car is a zero or low emissions vehicle - battery electric, Hydrogen fuel cell electric, plug in hybrid electric vehicles with...